Biosimilars are finally widely available, although costs sometimes remain high

October 11, 2024

Market share of biosimilars based on time from launch and number of biosimilars

Researchers in Health Affairs evaluated the utilization and cost impact of biosimilars from 2017-2022 and found that biosimilars were being adopted and leading to large cost savings. Biosimilars are drugs that are almost identical to brand name biological medications and have the same clinical effects. The researchers found that biosimilar market share exceeded the brand name drug around three years after the first biosimilar was launched, and the average wholesale acquisition cost (WAC) dropped about 10% and the average sales price (ASP) dropped about 30%. These data predominantly reflect biosimilars purchased through providers as part of the medical benefit, as the study was concluded prior to the launch of first biosimilar for Humira in January 2023. Humira is the first biosimilar that is predominantly purchased through the pharmacy benefit.

However, biosimilar adoption has been substantially slower in the US than in Europe, and recent experience with the delay of adoption of biosimilars for adalimumab (Humira) suggest that plans continue to overpay for biologic drugs even after their patents expired.

During the first year that Humira was available from biosimilar manufacturers, prices ranged from 15% to 85% off brand name list price, and the higher priced biosimilars typically offered rebates. In some instances, the same manufacturers offered both the high and lost cost medications. Yet at the end of the first year of biosimilars for adalimumab, brand-name Humira retained 97% of the market. Following 2024 PBM formulary changes, the market share of adalimumab biosimilars has gone up, but transparent pricing remains an issue.

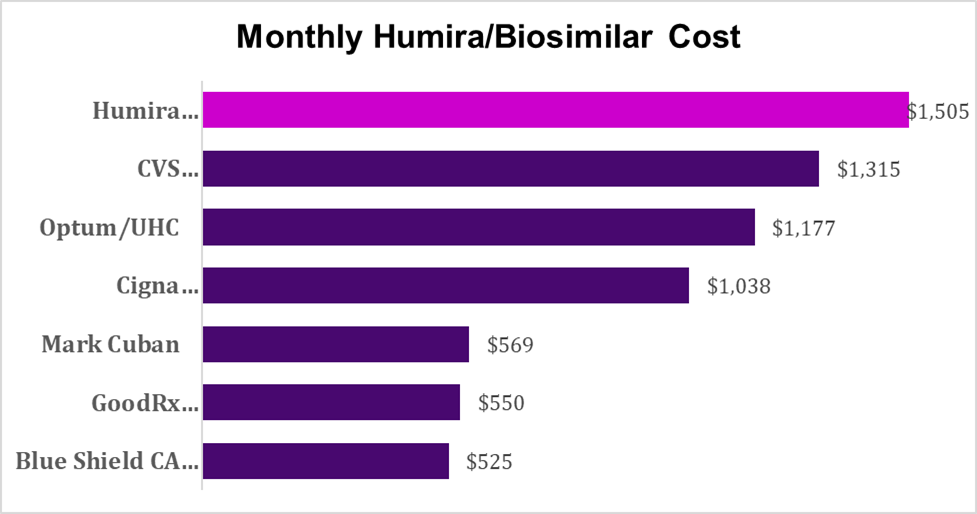

Bloomberg reported last week on costs of the Humira biosimilars currently preferred by the largest pharmacy benefit managers. The PBMs have placed their own biosimilars in the preferred tier on their formularies at prices that are high compared to other biosimilars, so that plans and members have not fully realized the savings potential from the transition from brand name biologics to biosimilars.

Sources: GoodRx (Humira from Costco) and Bloomberg (all others). These prices are net of rebates and may require coupons.

Implications for employers:

- Biosimilars are gaining traction and can lead to substantial cost savings for employer health plans. For example, WTW Rx Collaborative CVS data shows 84% Humira biosimilar utilization as of September 2024.

- It appears that biosimilars can lead to changes in acquisition costs similar to generic “small molecule” (non-biologic) medications. There are only small savings at first, and these savings increase after there are three or more biosimilar manufacturers on the market.

Employers can talk to their PBMs and consultants to assess whether they are gaining the financial benefit from the move to biosimilars.