Source: Whaley, et al RAND, May 13, 2024 LINK

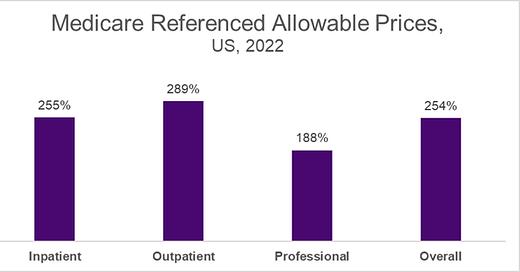

RAND published data earlier this week documenting what private commercial health plans paid for inpatient and outpatient care in 2022. This is from data donated by employers, state health plans and state all-payer claims databases. Researchers found that, on average, commercial plans paid hospitals 263% of Medicare fees for outpatient services, 233% of Medicare fees for inpatient services, and 254% of Medicare fees for combined inpatient and outpatient services. These results are similar to findings from this team’s research in 2018 and 2020.

Medicare-referenced prices are a good benchmark because they are adjusted for cost of living and hospital losses due to the uninsured. However, they are an imperfect reference for commercial plans as Medicare prices include payments to teach resident physicians.

The RAND researchers combined payments to all hospitals in each health care delivery system, so there is no separate reporting for academic medical centers and community hospitals that belong to the same system. This analysis does not include Maryland (which has regulated prices) or specialty hospitals such as cancer, pediatric, maternity or orthopedic hospitals. The data set represents about 6% of all medical claims, and fully insured plans are overrepresented as they are required to participate in all-payer claims databases.

There are vast differences from state to state. Five states had commercial prices that were under 200% of Medicare: Arkansas, Iowa, Massachusetts, Michigan, and Mississippi. Allowed prices were over 300% of Medicare in California, Florida, Georgia, New York, South Carolina, West Virginia, and Wisconsin. A supplemental appendix includes data on reimbursement by hospital system in each state.

Relative Prices by State

There are a few other important findings in this study:

A) Higher hospital allowable prices were highly associated with market leverage but were not associated with high rates of government reimbursement. This suggests that hospitals with high allowable prices are using market leverage, as opposed to obtaining higher prices, to make up for money-losing government reimbursement.

B) Ambulatory surgery centers had lower allowable prices (170% of Medicare hospital outpatient rates) than hospital outpatient departments (288% of Medicare).

C) Hospital allowable price was not correlated at all with the CMS stars quality rating.

Implications for employers:

- Private plans pay substantially more than Medicare for services, but that doesn’t mean that the Medicare fee schedule would be correct for private plans. Health policy experts think private plans should pay more than governmental plans, although few think the difference should be this large.

- The amount paid by private plans differs dramatically by geography. This research underestimates the difference among different providers because it reports on all hospital payments in a system, which often comprises both academic medical centers and community hospitals.

- This data is a good supplement to transparency data from hospitals and health plans, which thus far have been either incomplete or difficult to collect and review.

- Employers can ask their carriers what they are doing to address high unit costs, although in many instances health care delivery systems have substantial leverage at the negotiating table because employers are not eager to cause member disruption.

- The US health care cost crisis is largely due to high unit cost, not high utilization.

Thanks for reading. You can find previous posts in the Employer Coverage archive

Please subscribe, “like” and suggest this newsletter to friends and colleagues. Thanks!

Monday: Telemedicine had little impact on overall cost of medical care