Source: KFF Annual Employer Health Survey, October 10, 2024

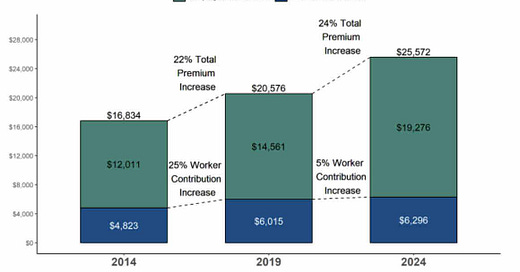

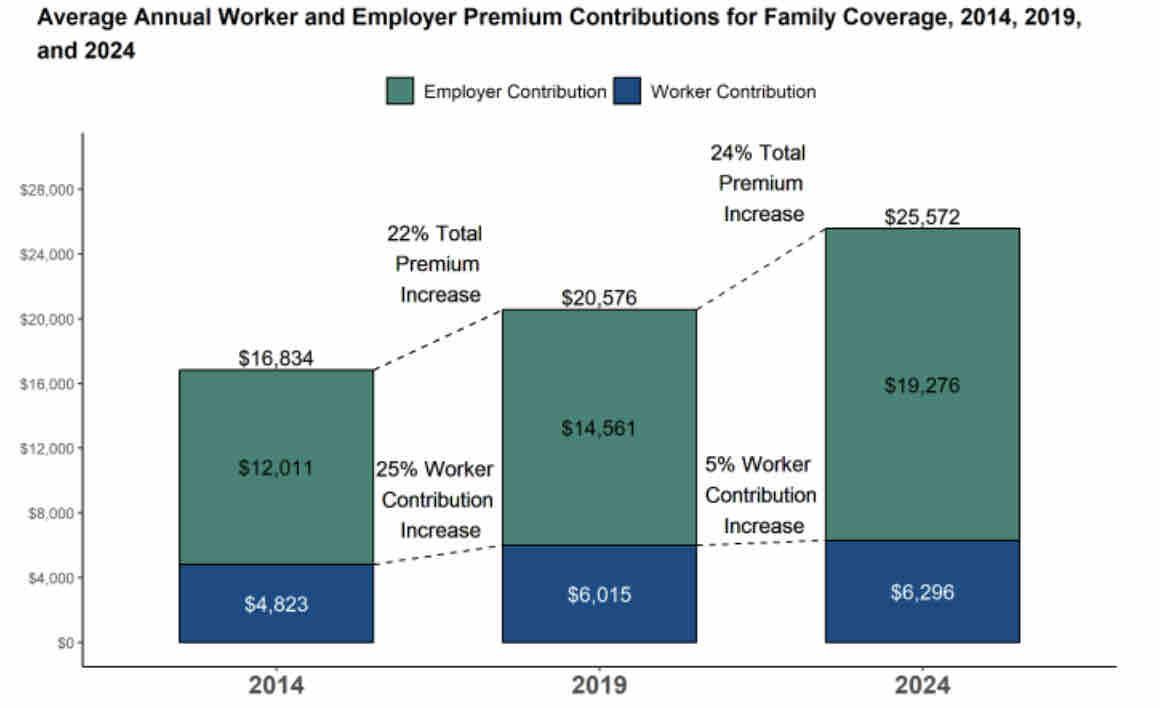

KFF (formerly Kaiser Family Foundation) published its annual employer health survey last week - and it showed that health care premiums rose over 7% in the last year. The average cost of a family plan is now $25,572 - more than the cost of an economy automobile. The KFF data shows that worker earnings have increased more in the last five years (28%) than worker share of health insurance premium (5%.) The KFF survey shows that average deductibles have been stable over the last five years, and about two thirds of family plans have out of plan maximums of $3000 or more, and a quarter (24%) have out of plan maximums of $6000 or more. This survey is of plan design rather than member cost sharing, so it does not report on total out of pocket costs. Those costs have likely increased as employers have “bought down” to lower actuarial value plans to address the large rise in costs. Higher out-of-pocket costs at the point of service are more likely to be incurred by those with serious illness and are most likely to cause financial insecurity among low-wage workers.

KFF reports that 63% of employees in the companies that responded to the survey are in self-funded plans, similar to previous years. They also report that 36% of employees in companies with under 200 employees are in “level funded” plans, which combine an element of self-insurance with reinsurance.

KFF reports much lower rates of coverage of GLP-1 drugs for obesity than in the 2024 WTW Best Practices in Healthcare Survey. WTW reports that 52% of employers provide such coverage, while KFF reports that even among employers with over 1,000 employers only 28% cover these medications. The KFF survey includes far more small employers than the WTW survey, and was performed in January to March, while the WTW survey was completed in July. KFF reports that almost a third of respondents reported that they did not know if they covered these medications. Separately, KFF reported that over 57 million people in private health insurance plans had BMIs or metabolic disease that would make them eligible for GLP-1 therapy.

The KFF survey also shows a high portion of respondents reported not knowing if their firm covered abortions. This is no surprise, as coverage for abortions is generally not listed as a specific benefit but is covered unless explicitly excluded. Many members of employer-sponsored health plans pay privately for abortions; some of them might not realize that this service is a covered benefit.

Implications for employers:

Continuing increases in the total cost of health care are a threat to many businesses.

While employers have shielded their employees from the increase in premiums, “buydowns” which increase out of pocket costs pose a threat to those who have serious illnesses and those with lower wages.