Friday Shorts: Pharmacogenomic testing, vaccines and medical debt and marketplace premiums

June 20, 2025

A. Pharmacogenomic testing can save lives when patients are prescribed 5-FU for cancer treatment

The chemotherapy 5-fluorouracil (5-FU) is generic, inexpensive, and frequently used to treat colorectal and other cancers. Unfortunately, some patients have a deficiency of the enzyme which metabolizes this medication. They can be severely injured or even die if they are given the usual dose of this medication. Pharmacogenomic testing to assess whether patients are at high risk of adverse effects from these drugs is standard practice in Europe and at a few medical centers, but the National Comprehensive Cancer Network guidelines do not explicitly recommend this testing, and many insurance companies don’t provide coverage. The testing generally costs about $300.

Arthur Allen of KFF Health News published a second article on the hazards of prescribing 5-FU (or capecitabine, a similar oral drug) without first testing patients. Here’s a link to his first article on this in 2024. Employers should be sure that their carriers are covering this test before plan members are started on these chemotherapy agents.

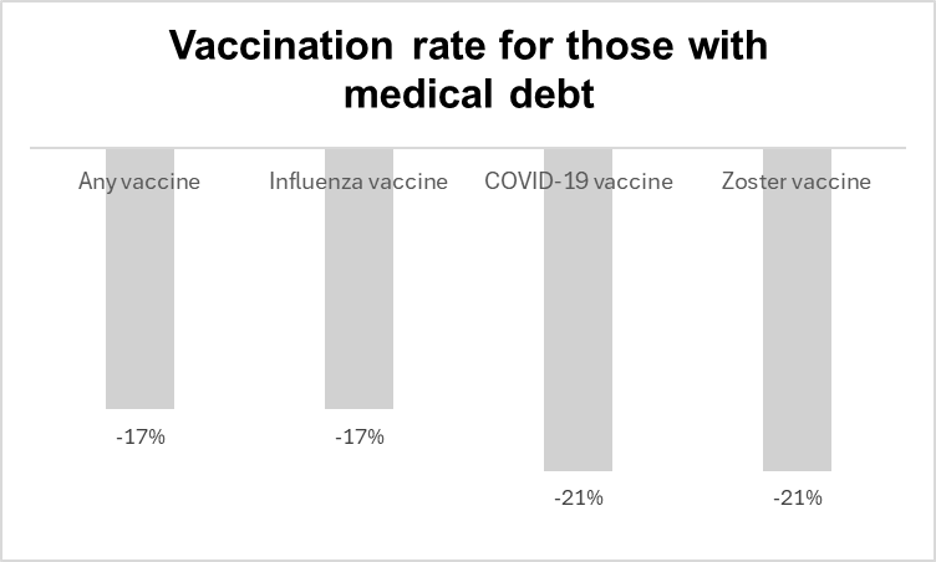

B. Vaccination rates lower for those with medical debt

Source: Himmelstein, J Gen Int Med June, 2025

Researchers used the results of the 2021-2022 National Health Interview Survey to assess the correlation between reported medical debt and receipt of vaccinations. Those with medical debt had been no less likely to get vaccinations the previous year, but were significantly less likely to have obtained vaccinations in the year that they reported medical debt. These results were adjusted[pt1] for sociodemographic, health, and access-to-care variables. This might be in part because those with medical debt avoided seeking medical care. This is a way that medical debt [pt2] could likely worsen health. Employers can can remind plan members that vaccinations have no cost sharing, and can generally be scheduled directly at pharmacies for members reluctant to make appointments with a clinical office.

C. Marketplace plan premiums likely to increase next year

Congress is debating a budget reconciliation bill that includes substantial cuts to Medicaid and does not extend existing subsidies for exchange plans associated with the Affordable Care Act. KFF Health News reports that an estimated 4 million will not continue their exchange plans if subsidies are not extended.

Since members dropping coverage are likely to be healthier, those remaining will have higher costs both because they lose subsidies and because the health status of the pool of those having these insurance plans will have a higher risk status. Some employers might see a higher number of employees seeking to add dependents to their plans if the exchange subsidies are not extended.