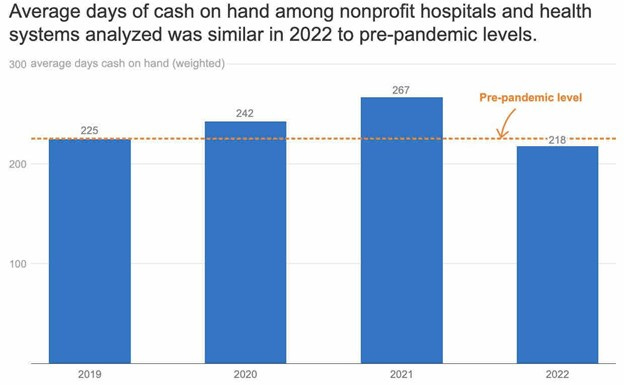

Source: Levinson, et al, KFF January 10, 2024 LINK

Many hospitals have shown operating losses over the last 2 years - and are using these operating losses to justify large rate increase proposals in negotiations with health plans. However, a KFF review of 2022 Standard and Poor’s (S&P) reporting for 127 nonprofit hospitals and hospital systems (representing about two thirds of all nonprofit hospital beds) found that most hospitals had an “adequate” or “strong” amount of cash on hand. This means that with no new revenue, they could pay all of their expenses for over 110 days. Nine percent of hospitals were ‘vulnerable’ or ‘highly vulnerable,” having under 110 days of cash on hand.

Some hospitals more likely to be struggling, including small and rural hospitals, are underrepresented since they are less likely to provide this kind of data to S&P.

This report also showed that hospital financial reserves declined substantially in 2022 due to lower stock market prices. The stock market was up substantially in 2023, which will increase hospital financial reserves. However, the stock market rally won’t help strapped hospitals with few reserves.

Implications for employers:

Higher hospital prices will continue to drive medical inflation.

Hospitals at risk are likely disproportionately rural hospitals and hospitals that serve underprivileged communities, so employers might face additional areas of provider deserts in coming years.

Many nonprofit hospitals are well-positioned financially heading into 2024. Indeed, at the JP Morgan conference in San Francisco in early January, many nonprofit systems were boasting of their “strong cash reserves.”

Thanks for reading. You can find previous posts in the Employer Coverage archive

Please “like” and suggest this newsletter to friends and colleagues. Thanks!