Summary: Increases in health care premiums have substantially decreased other forms of employee compensation. This has been especially economically damaging for low wage workers.

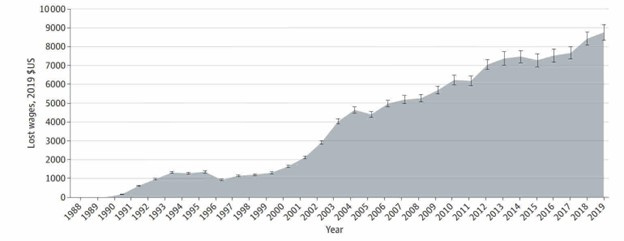

Lost employee wages due to employer sponsored health insurance increases 1988-2019

Source: Hager, et al JAMA Network Open January 16, 2025

Economists have long asserted that increases in the cost of health insurance premiums displace other forms of compensation, such as retirement contributions or wage increases. Researchers in JAMA Network Open found that increases in health insurance premiums between 1988 and 2019 led to about a 4.7% decrease in employee wages. The average employee would have had about $8000 more in income in 2019 if health insurance premiums had only increased at the rate of inflation.

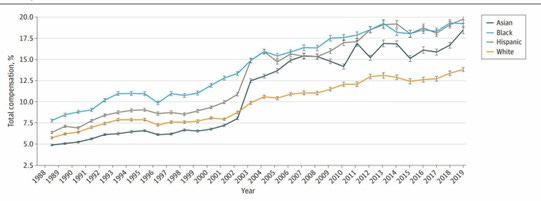

The impact of health insurance premium increases is far worse for lower wage workers, as health insurance premiums represent a much larger portion of their total compensation. About a quarter (27%) of employers use salary banding, where they charge lower wage workers a smaller portion of health insurance premiums to reflect their ability to pay. Health insurance price increases also encourage employers to automate or offshore work that was previously performed by lower wage workers.

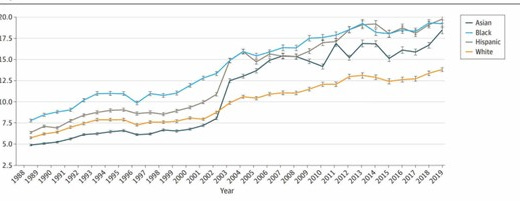

Health Insurance Premiums as Portion of Total Compensation 1988-2019

Source: Hager, et al JAMA Network Open January 16, 2025

Implications for employers:

● Lowering the cost curve on health care premiums can help employers offer better wages or other forms of compensation.

● Rapid increases in health insurance costs are more likely to cause financial insecurity among low wage workers.

Structuring financial contributions to reduce costs for lower wage workers can help, but this problem will persist until health care cost inflation slows.

Tomorrow: Rural-urban and racial disparities in cervical cancer persist