Health plan carriers negotiate high-stakes contracts with provider organizations across the country, and until now the results of those negotiations have been cloaked in secrecy. Contractual prices are considered proprietary by both health plans and hospital systems, and unraveling allowable payments has been difficult. The federal hospital transparency regulations, which went into effect on January 1, 2022, should have made it easier to ascertain relative prices, although compliance with these rules has been spotty, and creating comparisons takes a data scientist. Health plan carrier transparency rules, which went into effect this year, should shine a brighter light on reimbursement rates.

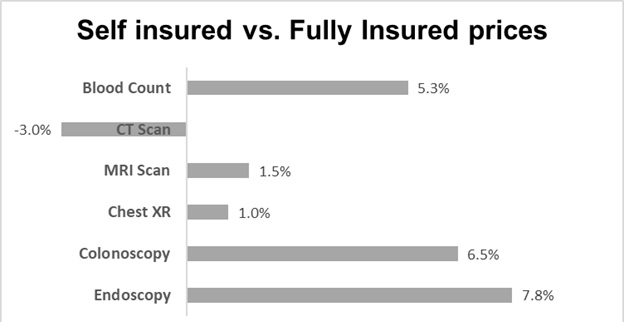

In the meantime, the Health Care Cost Institute, which has a database of claims from about 45 million individuals on employer-sponsored health insurance, published research in Health Affairs this month demonstrating that in 2021 plans that were self-insured paid more for many procedures than plans that were fully insured.

Here’s a sample of their findings:

Source: Sen, et al Health Affairs September, 2023 LINK

The strength of this study is its huge size. However, the authors point out that fully insured plans were much more likely to be HMOs (18.9%) compared to self-insured plans (2.3%), and HMOs generally had lower prices. Adjusting for this, the difference decreased, although self-insured plans in general still paid higher rates. The database did not list the specific payer (Aetna, Humana, and 30 BCBS plans submit data to the HCCI database), so the researchers could not compare self-insured vs. fully insured prices for each specific health plan.

Implications for employers:

This data shows that HMOs obtain lower unit prices. However, employers rarely include HMO plan designs in their self-insured plans for a variety of reasons including relative inability to “share risk” with providers in self-insured plans. This research suggests that HMO plan design might be valuable to some employer health plans.

For large employers, the advantages of self-insurance, including uniform plan design across all state boundaries and exemption from state regulations and taxes, will continue to be advantageous even if there is a modest price differential.

Employers should evaluate the prices that they will pay when they are choosing carriers, which might be different from prices carriers obtain for fully insured plans, where they pay medical costs directly.