I’m off today – and here is a slightly updated post from September. CMS announced its initial price offers as part of the Inflation Reduction Act’s pharmacy drug negotiations this week. We don’t know the details of these offers, which will only be made public if the pharmaceutical companies choose to do so. Negotiations will be concluded by September, 2024, and will go into effect on January 1, 2026.

Last fall, the Centers for Medicare and Medicaid Services announced the first ten drugs for which it will negotiate prices. Nine of the ten drugs for which Medicare will negotiate prices are in the top 100 pharmaceuticals in employer sponsored health insurance, and these represent 15.5% of total pharmacy spending for employers. These lower prices would take effect in January, 2026. The Centers for Medicare and Medicaid Services would add 10-20 drugs to its negotiation list each subsequent year.

Source: WTW RxCollaborative on file, Q1-Q2, 2023

Here are my thoughts on potential impacts of the Medicare drug price negotiations on prices paid by employer-sponsored health plans.

(Active links are below)

Lower pharmaceutical profits could lead to decreased investment, which would decrease research and development and diminish the number of new drugs approved and marketed in the US. The Congressional Budget Office estimated that the IRA would lead to a decrease of one new drug in the next decade, and 13 new drugs in the next three decades. Currently, there are 38 new drugs approved each year.

Why is there little effect on pharmaceutical innovation? Pharmaceutical companies are likely to be able to continue to earn high profits because Medicare cannot negotiate prices for “small molecule” drugs that have been approved for less than nine years or biologic drugs that have been approved for less than thirteen years. The Inflation Reduction Act also decreases out of pocket costs for Medicare beneficiaries, which could increase utilization and offset some margin loss caused by lower prices. A Brookings research report last month showed no recent decrease in pharmaceutical financing activity that would suggest fewer new drugs in the future.

The IRA also eliminates some Medicare beneficiary cost sharing, so will likely increase utilization of some expensive medicines.

The IRA and Medicare price negotiation could lead to changes in patterns of rebates. Inflation penalties discourage increases in list prices coupled with increases in rebates, although if pharmaceutical companies increase launch prices they could couple these higher launch prices with higher rebates.

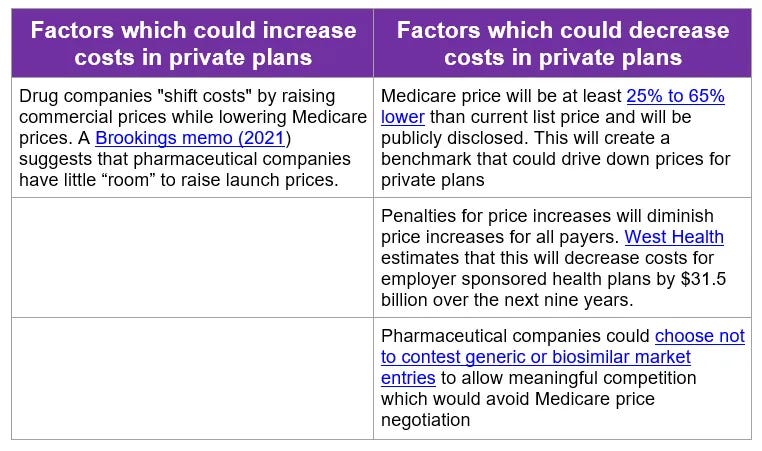

Implications for employers:

- The Medicare price negotiations will lead to lower Medicare prices beginning in 2026, but it will take longer to assess the impact of these negotiations on prices paid by private insurance.

- Even if the Inflation Reduction Act leads to lower prices of targeted drugs, marketing of valuable new drugs could still mean that the total drug spending by employers continues to increase, albeit at a lower rate than expected.

- Employers should consider the potential impact on drug prices and rebates as they negotiate pharmacy benefit manager contracts over the coming years, to be sure that they and their beneficiaries gain credit for any reductions of unit prices of the most expensive drugs.

Here are active links for the second table:

- Brookings Memo

- 25-65 % lower

- West Health

- Not to contest generic or biosimilar entry

Thanks for reading. You can find previous posts in the Employer Coverage archive