Morgan Health report highlights challenges for lower income employees

March 12, 2024

Source: Morgan Health “Health disparities in employer sponsored health insurance” February, 2024 LINK

Morgan Health, a division of JP Morgan Chase, just released its second report on health care disparities. The report focuses on health utilization by income, LGBTQ experience, and preventive care, mental health and pregnancy outcomes by race. I’m going to focus today on their analysis of disparities by income, and I’ll have a later post on some of the other topics.

Morgan Health worked with NORC of the University of Chicago to cross-reference the National Health Interview Survey, the National Study on Drug Use and Health, and the National Vital Statistics System to segment the population for this analysis. This analysis used data from 2021.

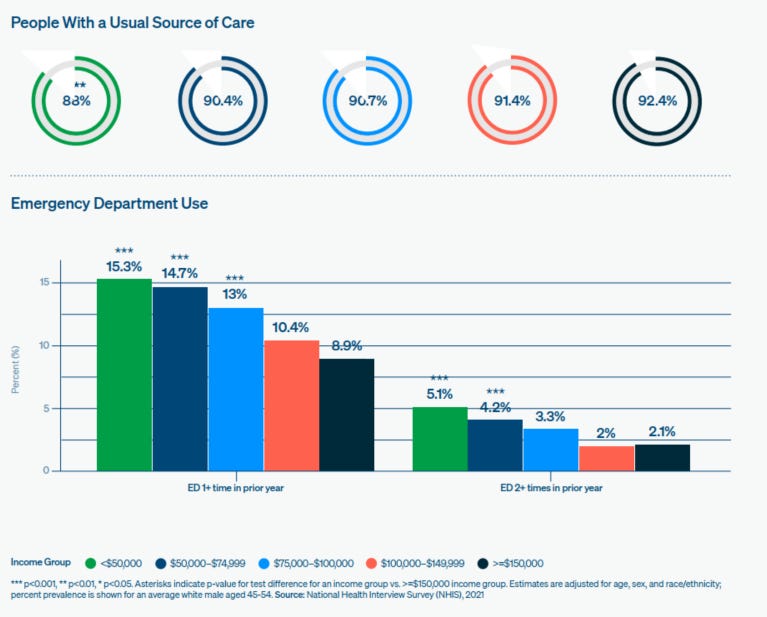

The graphic above shows that people earning under $50,000 annually were least likely to have a regular source of care (upper donut graphics) and were most likely to visit the emergency department. Those who earned under $50,000 were 2.4 times more likely to have two or more emergency department visits than those with income of over $150,000.

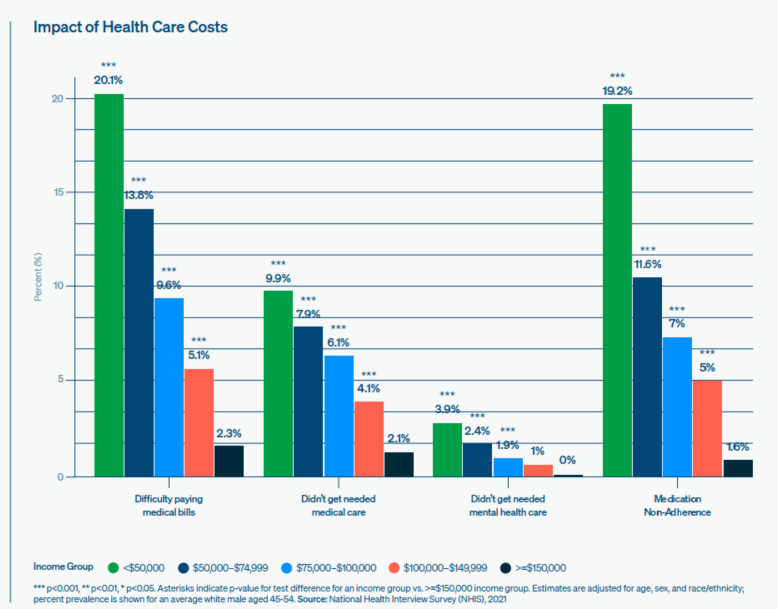

The researchers also found that those who earned between $50,000 and $75,000 were almost twice as likely to have difficulty paying medical bills compared to those who earned $100,000 or more, and those who earned less than $50,000 were almost four times as likely to be non-adherent to their medications as those who earned over $100,000, and those who earned $50-$75,000 were over twice as likely to be non-adherent to prescribed medications.

Source: Morgan Health “Health disparities in employer sponsored health insurance” February, 2024 LINK

Lower income employees and their families are less likely to have a regular source of care, and more likely to visit emergency departments, at least in part due to the inflexibility of their jobs. Some might also not have time to get routine care if they work multiple jobs. Most “routine” medical care is delivered during business hours, and many lower wage workers simply cannot afford to be away from work for multiple hours during the business day. Other challenges for low wage workers include:

Transportation

Access: There are often few medical providers in neighborhoods where more low wage workers live (medical deserts)

Language difficulties

Cost sharing

Implications for employers:

Salary banding (lower premiums for lower wage workers) can make insurance premiums more affordable for low wage workers.

Plans with higher actuarial value for low wage workers can alleviate some of the out of pocket burden for workers and their families most at risk

Employers can offer leave and flexibility to make it easier for lower wage workers to obtain routine medical care.

Education about plan design and reassurance that preventive care is covered with no out of pocket costs can help increase preventive services utilization and regular source of care.

Employers should generally not require physician notes to return from a medical absence, as this is more likely to lead to emergency department use for those who have no regular source of care.

Some employers offer on-site care to ease access to employees, and some also offer services to family members.

Here’s a link to an article that my colleague Steve Nyce, PhD and I authored in Harvard Business Review on this topic in 2019

Thanks for reading. You can find previous posts in the Employer Coverage archive

Please subscribe, “like” and suggest this newsletter to friends and colleagues. Thanks!

Tomorrow: State regulation leads to fewer low value imaging tests