New data shows frequency of insurance denials

Source: KFF, Pestaina, et al KFF June 15, 2023

Many consumers are ambivalent about health insurance plans. They appreciate having health insurance to negotiate prices and pay bills but are often angry at health plans that interpose themselves in medical decisions and irritated when they have trouble gaining access to in-network providers. The data above is from a KFF survey in mid-2023, and at the time I was surprised that six in ten reported some type of problem with either health plan network or coverage.

A new study demonstrates one reason why people are dissatisfied with their health plans.

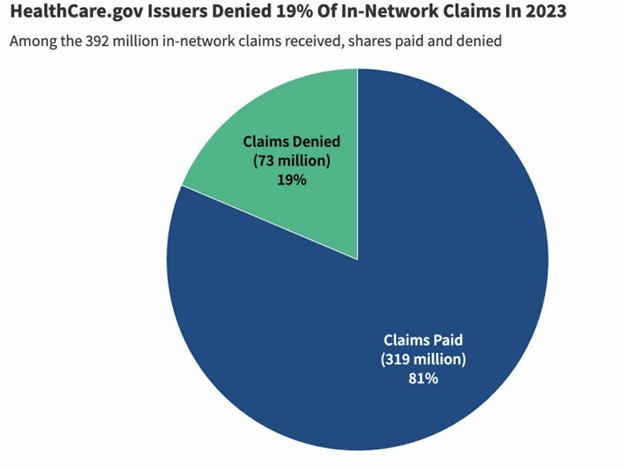

KFF just reviewed 2023 data on insurance denials, which are required to be reported under the Affordable Care Act. They found that marketplace (exchange) health plans denied 20% of all claims (37% of out-of-network claims, and 17% of in-network claims). This means that one in six claims for in-network services were denied. Fewer than 1% of these denied claims were appealed, and more than half of those denials (56%) were upheld.

Source: Lo, et al KFF January 27, 2025

This data includes only plans that are still offered (so a plan that was discontinued would not report) and is limited to states that use the federal marketplace. Data from California, which has its own marketplace, was similar. The actual portion of denials varied widely among plans; in-network claims denials ranged from 13-35%. Average in-network denials were similar (21%) in Covered California, the exchange marketplace in that state, which also requires plans to report denial data.

This is data on denials for exchange marketplace plans, and there is not, to my knowledge, a similar database for employer-sponsored health plans. Employer-sponsored plans, which are self insured, could have lower claims denial rates than exchange plans, which are fully insured. A high rate of payment denials in employer-sponsored health plans could help explain consumer dissatisfaction.

Implications for employers:

Many denials are due to provider administrative errors, and some are because providers are requesting approvals for non-covered services or low value services or even harmful services.

Employers can require that their carriers regularly report denial rates and appeals outcomes, to be sure that plan members do not experience unnecessary abrasion from health plan utilization management initiatives.

Employers should encourage provider “gold carding,” so that providers who follow evidence-based guidelines do not have to seek prior authorizations.

Contractual requirements for prompt turnaround for emergency and urgent prior authorizations can improve member experience and prevent dangerous delays in treatment.

Prior authorization is most important for services for which there is good evidence and where the proposed service is either expensive or has substantial chances of adverse effects.

- Here’s a link to a 2023 post on why prior authorization denials made by AI should be reviewed by humans.