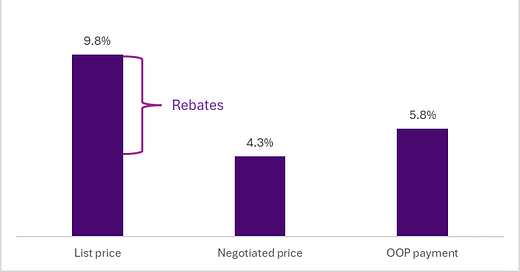

Source: Mallatt, et al Health Affairs September, 2024 LINK This shows that annualized price increase of a sales-weighted set of brand name drugs rose 9.8%,but the actual negotiated price rose only 4.3%. Therefore, member cost sharing increased during this time period.

Pharmaceutical products get better with each passing year, but the prices increase dramatically. Employers feel the pain of increased pharmacy costs, which make up a progressively larger portion of the total budget. But plan members have also seen their out-of-pocket costs go up. Researchers in this month’s Health Affairs demonstrate that plan member payments have risen faster than insurance costs between 2007-2020.

Researchers paired commercial retail claims data with a database that estimates rebates to ascertain total cost of all retail pharmaceuticals purchased on behalf of a panel of between 1.7 and 3.5 million commercially insured members each year. They created an ‘index’ to account for changes in membership and allow year-to-year comparison. The cost borne by members went up 5.8% annually, meaning that over this period members were responsible for a higher portion of total retail pharmacy costs. Higher deductibles were responsible for much more of the increase than increased coinsurance costs.

Implications for employers:

The “gross to net bubble” where list prices continue to rise (gross cost) and are offset by higher rebates (so the “net cost” is not much changed) increases cost sharing for members whose cost sharing is dictated by the gross cost (list price) rather than the actual cost.

Point of sale rebates could address this problem, but only a small minority of companies use this plan design.

Companies should be aware of the increasing share of brand name pharmaceutical costs borne by members.