Preventive services, prescribing restrictions, and potential impact of Medicaid disenrollments on employers

April 7, 2023

Happy Friday,

Today, I’ll examine in more detail the potential impact of the recent judicial decision overturning a portion of the Affordable Care Act rule requiring no cost sharing for some preventive services. On reflection, this decision looks narrower than I first thought. I’ll review how changes in rules on prescribing with virtual care can adversely impact medical care for opioid use disorder and care for transgender people and review some preliminary data about the potential impact of Medicaid disenrollments on employers.

1. Judicial decision will impact coverage of a small subset of preventive services.

Employer-sponsored health plans have been required to provide certain preventive services with no out-of-pocket costs since the Affordable Care Act. There are three types of preventive care that are required

a) ACIP (Advisory Committee on Immunization Practices) - Vaccinations recommended by the Advisory Committee and endorsed by the Director of the Centers for Disease Control and Prevention (CDC). This includes childhood and adult vaccinations.

b) HRSA - Women’s health services recommended by the Health Resources and Services Administration (HRSA) and endorsed by the Secretary of Health and Human Services. This includes prenatal care, contraceptives, and wellness examinations.

c) USPSTF - Screening and other care recommended by the US Preventive Services Task Force (USPSTF). This includes screening for colon, breast and cervical cancer based on gender and age, screening segments of the population for other diseases, and pre-exposure prophylaxis (PrEP) to prevent transmission of HIV.

A full list of covered services is available on healthcare.gov, and Kaiser Family Foundation has a list of which services are recommended by which authority.

These services are widely used. Every family with children is shielded from out-of-pocket costs for vaccines, and those getting birth control and various screening tests do not need to consider the cost of this care. Kaiser Family Foundation estimates that 100 million Americans had cost-sharing waived due to this mandate in 2018.

Source: Peterson KFF Health System Tracker, March 23, 2023 LINK

Preventive services are inexpensive in the context of total medical expenses. Even PrEP, which is 99% effective at preventing transmission of HIV in high risk individuals, is now available generically, and costs just $26 a month. Vaccinations and birth control are cost-saving, and the incremental employer spending to eliminate out-of-pocket costs for all of these services is quite modest.

Eliminating out-of-pocket costs for high value services is a fundamental precept of value based insurance design (VBID). Since we know that even modest out-of-pocket costs depress utilization, we should offer low or zero cost sharing for the highest value services. Pharmacy benefit managers maintain ACA Preventive Drug Lists that remove cost sharing for targeted Rx and OTC medications, including: aspirin, sodium fluoride, folic acid, smoking cessation, immunizations, bowel prep for colonoscopy, statins, HIV PrEP, contraception, breast cancer risk reduction.

Last week’s federal district court decision that the preventive care mandate violates the Appointments Clause of the US Constitution relates to only USPSTF recommendations finalized after the Affordable Care Act was passed in March, 2010. The decision has been appealed by the Biden Administration, although the opinion is in effect unless the judge or an appeals court issues a stay.

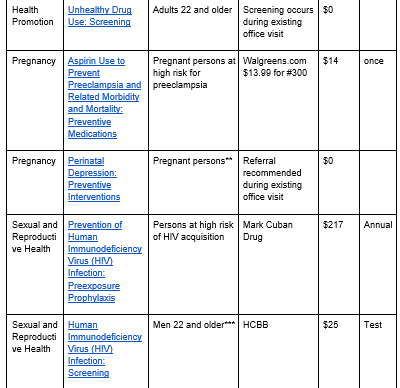

Here’s a list of the services covered by this ruling and the associated cost - you’ll see it’s narrower than many initially thought. For instance, recommendations for colonoscopies ages 50 and above were completed in 2002 and revised in 2008, so they are still in place. However, the USPSTF recommended colonoscopy for those from 45-49 in 2019, so that mandate would no longer be in place under the ruling. Here’s a summary of what recommendations are affected according to KFF.

NOTE: *Coverage for colorectal cancer screening is still required for adults 50-75. **Coverage for postpartum depression screening is still required. ***Coverage for HIV infection screening is still required for adolescents up to age 21 and all women. Grid from KFF LINK and three right columns by author

Implications for employers

- Few employers will change their plan benefits mid-cycle and when the litigation over this ruling is not completed. The existing evidence of coverage states that these services will be covered, and most members are counting on this.

- Internal revenue code rules around health savings accounts have not changed, so tax-deductibility of health savings accounts should not be adversely impacted by continuing to provide coverage with no out-of-pocket costs for these services. We will need to see if this is formally addressed by the IRS; in the meantime, employers can discuss this issue with legal counsel.

- The cost to employers of keeping benefit plans up to date with the most current guidelines will be quite modest.

- Continued coverage of these services helps demonstrate the employer’s continued commitment to improve member health.

2. Upcoming restrictions on prescribing could complicate transgender and opioid use disorder treatment

The Pandemic Emergency is scheduled to end on May 11, and President Biden is expected to sign a congressional bill ending the pandemic emergency up to a few weeks earlier.

Regulators eased rules on prescribing without in-person visits during the pandemic emergency, so that prescribers were able to do assessments and follow ups of patients remotely. This has been good news for patients, who were able to get medical therapy without time away from work. There were also allegations that some virtual care startups were prescribing medications for conditions like Attention Deficit Hyperactivity Disorder without adequate evaluation.

Drug Enforcement Administration regulations require in-person evaluation for initial or subsequent prescriptions for potentially abusable medications, which were waived during the pandemic emergency. The requirement for an in-person evaluation will go back into effect when the pandemic emergency ends. On February 24, 2023, the Drug Enforcement Administration announced proposed rules. The proposed rule may allow for 30-day supply of buprenorphine for the treatment of opioid use disorder; however the final rule has not been published at this time. This creates special challenges for those being treated for opioid use disorder, who might have difficulty getting in-person appointments for regular check-ins. These individuals were generally required to complete drug testing even through the pandemic, so the risk of abuse of drugs used to treat opioid use disorder is small. Medication assisted treatment (MAT) allows many who have been addicted to opioids to work and return to normal life.

New requirements for in-person visits will be a special burden for trans men or gender diverse individuals receiving gender-affirming testosterone therapy. Testosterone is a controlled substance, so prescribers will no longer be able to assess or monitor patients on testosterone therapy via remote visits. This will be a special challenge for members living in rural areas, or in states that are enacting laws that restrict transgender care.

Implications for employers:

- Employers can check on network adequacy within their carriers for both opioid use disorder care and transgender and gender diverse care. Many communities don’t currently have enough prescribing physicians in both of these areas to meet community needs.

- For transgender and gender diverse care, some employers offer travel benefits for members who don’t have access to inclusive care in their own communities. Employers may want to monitor the limits of those travel benefits to understand if these new regulatory changes cause an increase in the need for medical travel.

- Employers can advocate for continued access to telehealth to treat those who will have difficulty obtaining in-person visits to obtain these important treatments.

3. Employers could see decrease in employees waiving employer-sponsored health insurance with changes in Medicaid enrollment

During the pandemic emergency, states were required not to disenroll Medicaid beneficiaries, and Medicaid enrollment grew by about 20 million. This helped the country avoid having many people uninsured as a respiratory pandemic was causing widespread illness and death.

Experts believe that around 15 million will leave the Medicaid rolls during the rest of 2023 as a result of the end of the pandemic emergency. Almost half of these people could still be eligible for Medicaid, but will lose their coverage because they did not receive or respond to notices. This will almost certainly raise the rate of uninsurance and will be a challenge to health care delivery system finances, especially in states that did not expand Medicaid.

Employers should take note that many people who have remained on Medicaid through the pandemic could be eligible for employer sponsored health insurance. This could include employees who were hired since March, 2020 and waived coverage, as well as dependents where the employee elected individual coverage because partners, spouses or children remained on Medicaid. The Department of Health and Human Services estimates that Medicaid disenrollment will mean 3.6 million more on the rolls of employer sponsored health insurance, while the Urban Institute estimates 9.5 million will join employer-sponsored health insurance.

Sources:

Left:Assistant Secretary for Planning and Evaluation, Health and Human Services August, 2022 LINK

Right: Urban Institute, December, 2022 LINK

Employers with low wage workers and more frequent turnover are likely to see a larger number of newly covered members due to this change

Implications for employers:

- Be ready for an increase of employees filing for new or changed coverage due to Medicaid disenrollment of themselves or family members, which qualifies as a life event. Some low-wage employees might remain eligible for subsidized marketplace health plans.

- These changes may impact total cost of employer sponsored health insurance in late 2023 and beyond

Hope all have a great weekend when it comes!

Jeff