Provider consolidation drives up anesthesia prices

March 27, 2025

Source: Asil, et al National Bureau of Economic Research, March, 2025

U.S. medical care is much more expensive than care in other countries due to high unit prices. Increases in unit price have driven a substantial portion of medical inflation over recent decades. We know that provider consolidation increases provider leverage and leads to higher prices paid by employer-sponsored health insurance. Antitrust regulators have long targeted hospital mergers, but the Federal Trade Commission has only recently started scrutinizing the inflationary impacts of “rollups” where investors purchase multiple previously competing medical groups in a single market.

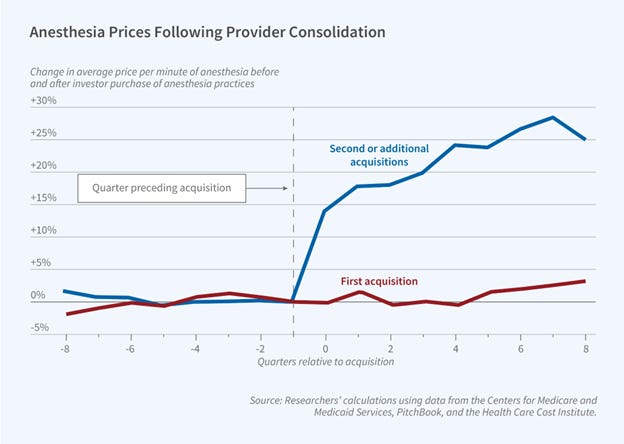

Economists reviewed data from 18 markets that saw such roll-ups in anesthesia. They found that the first investor acquisition had little impact on the cost of anesthesia care. However, subsequent acquisitions led to an 18% increase in prices paid by employer-sponsored health plans six months after the second acquisition. The researchers linked a national file of providers to merger and acquisition data and to de-identified commercial claims data from the Health Care Cost Institute. The researchers found no evidence that the acquisitions increased the quality of anesthesia care.

Implications for employers:

● Provider consolidation continues to be an important inflationary factor in many markets.

● Balance billing protection from the No Surprises Act only limits allowable prices for emergency services and hospital-based physicians. For elective procedures performed outside of a hospital, a rolled-up anesthesia group with substantial negotiating leverage would be able to increase its allowable charges considerably.

● Continued state and federal antitrust scrutiny of “roll ups” of physician specialty practices could protect against increased costs

Thanks for reading. You can find previous posts in the Employer Coverage archive

Please subscribe, “like” share this newsletter with friends and colleagues. Thanks!

Tomorrow: Friday Shorts