RAND: hospitals receive 2.5X Medicare rates from employer sponsored insurance

Today's Managing Health Care Costs Number is 2.5

RAND published its third cycle of data showing the relationship between commercial insurance rates and the rates paid by Medicare in hospitals across the country. This is based on claims data donated by employers (including in some instances states), and shows just how ineffective private purchasers have been at controlling unit cost. That's exceptionally important, as US health care costs exceed the costs of all other countries because of high unit costs, not because of high utilization.

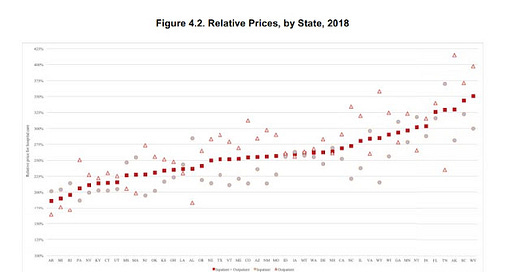

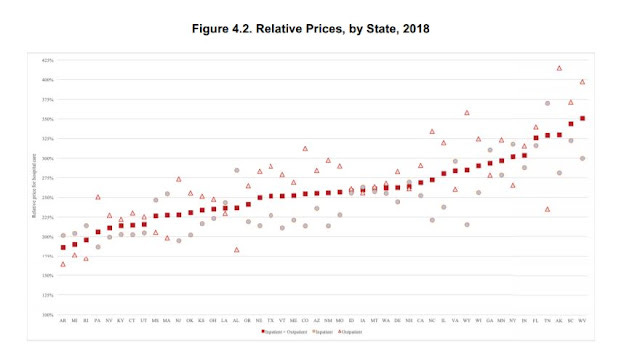

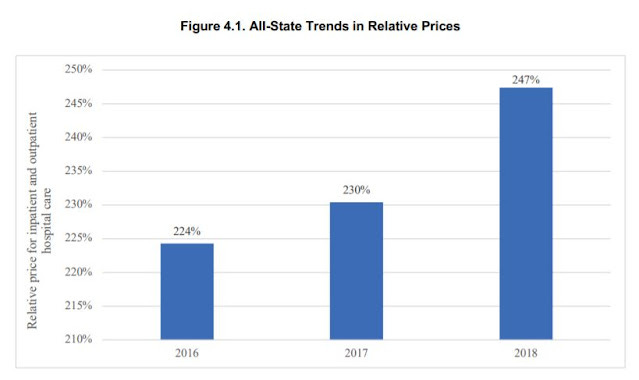

Above is the summary graphic from RAND - showing that average statewide hospital rates range from 186% of Medicare (Arkansas) to 351% of Medicare (West Virginia). This understates the differences that exist within states, though. I pulled out data for Massachusetts, where I live. You'll see that for delivery networks the range in overall allowable rates was 170% of Medicare (Baystate) to 269% of Medicare (Partners, now Mass General Brigham Health).

Christopher Whalen and his coauthors have also collected impressive evidence that low Medicare and Medicaid rates are not associated with higher commercial rates. Look at this scatterplot - showing essentially no relationship. Delivery systems which serve more Medicare and Medicaid patients don't routinely respond by higher allowable rates for their patients on employer sponsored health insurance.

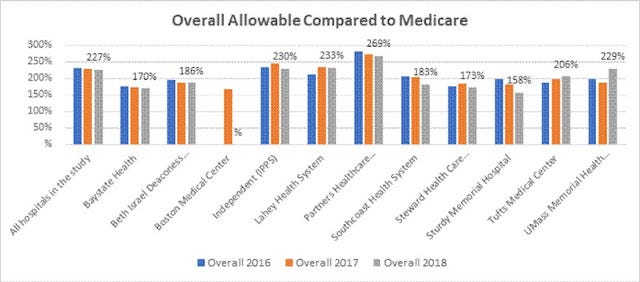

The study also shows that the commercial rates, as a percentage of Medicare, have risen since the first round in 2016. (Note that the y axis here is not set at 0).

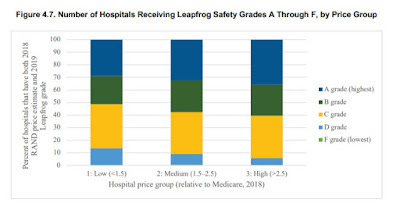

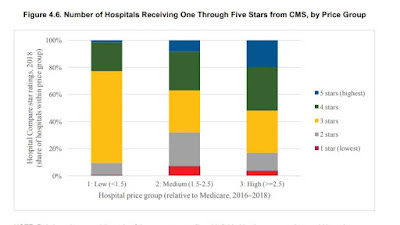

Note that most previous studies have shown no clear relationship between quality and cost. The RAND study shows that there are more poorly performing hospitals among those which receive the lowest rates. Clearly, there are many high performing delivery systems with lower costs - but purchasers should be aware that some lower priced facilities (and some higher priced facilities) might have worse quality and poorer outcomes.

Lessons?

1. Commercial rates exceed Medicare rates (often by a lot)

2. Variation in rates within states and even within metro markets is huge

3. Higher Medicare and Medicaid penetration does not necessarily cause high commercial rates

4. There is a small correlation of price to quality, but we can purchase high quality care at much lower prices

5. Commercial payers are not able to negotiate favorable pricing from high leverage provider organizations, and consolidation is likely to continue to make this worse