Sources: 2021 net price calculation: Hernandez, J Man Care Pharmacy, June 2024 LINK List and IRA prices, CNBC August 16, 2024 LINK

The Centers for Medicare and Medicaid Services (CMS) announced the negotiated prices for ten drugs last week. The drugs are broadly used and are especially high cost to Medicare. At the time, CMS said that the 2026 prices would lower CMS costs by $6 billion, and lower cost sharing for Medicare beneficiaries by $1.5 billion. In February 2025, CMS will announce the next group of fifteen drugs which will be subject to price negotiation for 2027.

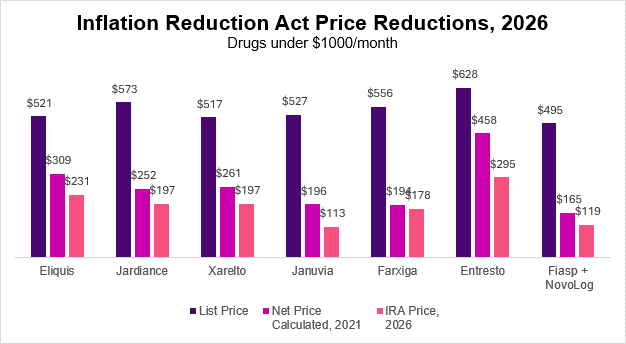

I noted previously that the cost of these medications would be between 38% and 79% less than list price, and between 10% and 30% from the current “net” prices after discounts and rebates.

Researchers calculated the net prices based on 2021 data. Here is a depiction of the difference between list and net prices (2021) and IRA (Inflation Reduction Act) negotiated price (2026). I’ve separated the expensive from the less expensive medications to highlight differences. This is an imperfect measure of what would have been the net price in 2026 without these negotiations. For instance, the manufacturer cut the price of Fiasp/novolog, an insulin, in 2023, so savings will be less than stated. In other instances, drug prices have increased since 2021, so savings will be larger than stated.

Sources: 2021 net price calculation: Hernandez, J Man Care Pharmacy, June 2024 LINK List and IRA prices, CNBC August 16, 2024 LINK

The CMS negotiations under the Inflation Reduction Act (IRA) only apply to prices for those covered by Medicare, and we have yet to see how these will affect prices paid by commercial plans. The IRA also has provisions to penalize drugmakers for raising prices by more than inflation, which could make pharmaceutical companies less willing in the future to raise prices and offset these by increasing rebates. Drug companies might seek to increase launch prices on new drugs, since they will be constrained in future price increases. On the other hand, raising launch prices can depress utilization, and some drugs with excessive launch prices have been business failures. (1) (2)

Here’s a link to a previous post on implications of IRA negotiations, initially written in 2023.

Implications for employers:

Medicare has often set the standard for pricing, and these are meaningful discounts on drugs that represented over 15% of 2023 pharmacy expenses for employers.

Employers and consultants can watch to see how their acquisition costs for these medications changes in 2026 and beyond.

I don’t believe employers should expect pharmaceutical companies to raise prices on drugs for commercial patients, as that would assume they were “leaving money on the table” and not charging prices that would have maximized their margins prior to this CMS negotiation.

Thanks for reading. You can find previous posts in the Employer Coverage archive

Please subscribe, “like” and suggest this newsletter to friends and colleagues. Thanks!

Monday: The US enjoys low generic drug prices