The US lags in savings from biosimilar medications

November 6, 2025

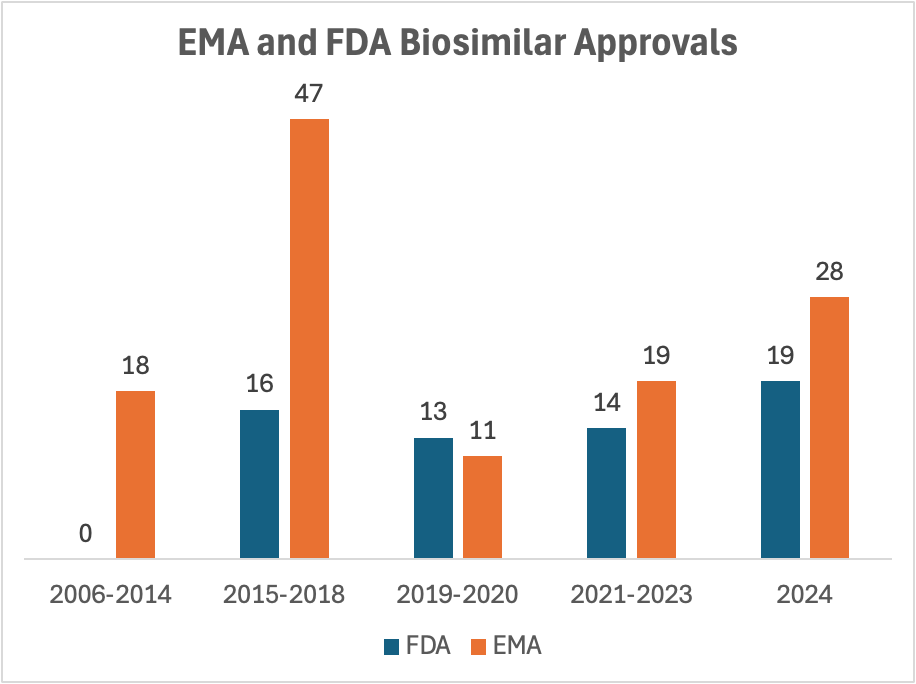

Summary: A combination of slow regulatory approval, legal challenges, and pharmacy benefit manager delays means that the US lags far behind Europe in receiving financial benefits of biosimilar medications

Source: I tasked two AI agents to collect this information, and they came up with similar answers. Source for Food and Drug Administration (FDA) approvals is the FDA Purple Book . Source for EMA approvals is Generics and Biosimilars Institute (GABI).

Public policy has long focused on high U.S. drug prices—where prescription medications cost, on average, more than twice as much as in other developed countries. This applies to both small-molecule drugs and biologics, which are harder to manufacture and enjoy longer patent protection. Generic drugs are less expensive in the U.S. than in other developed countries.

Biologic drugs account for many of the most expensive medications. The U.S. has approved far fewer biosimilars than Europe, allowing brand-name biologics to retain high prices even after patent expiration.

Barriers include the need for Phase 3 clinical trials to demonstrate equivalence, and strict FDA criteria for interchangeability—meaning a prescriber must specify the biosimilar brand unless it is deemed interchangeable.

The FDA recently announced plans to ease biosimilar approval requirements, which could improve access and reduce costs

However, regulatory changes alone won’t fix the problem. Legal tactics continue to delay biosimilar launches—for example, Humira’s first biosimilar entered the market roughly a decade after its patent expired.

Bloomberg reported last week on Rebif, a multiple sclerosis medication that was introduced in 2003 at $17,500 per year. Even though it lost its primary patent protection last year, the drug is now priced at $140,000. A biosimilar manufacturer would need to file legal challenges to secondary patents to gain FDA approval. There are no biosimilar drugs in the pipeline.

Pharmacy benefit managers (PBMs) also contribute to delays, often withholding biosimilars from formularies to secure additional rebates. In Humira’s case, many PBMs didn’t add biosimilars for a year and gave preference to higher-priced versions under their own labels.

These barriers discourage investment in U.S. biosimilars: only about 10% of the 118 biologic drugs set to lose their patents in the next decade have a biosimilar in the regulatory pipeline.

Implications for employers

FDA efforts to streamline biosimilar approval could help employers improve access to effective biologics at lower cost.

Employers can press their PBMs to quickly add lower-cost biosimilars to formularies and give them preferred status, or switch to PBMs that do this.

Thanks for reading! Please subscribe to this newsletter, and hit the “like” button. Please also recommend this newsletter to friends and colleagues - it’s free. You can find previous posts at this link.

Views expressed in Employer Coverage are purely my own.