Underinsurance in the US, COVID boosters could save billions, and failure of communication around COVID bivalent boosters

October 7, 2022

I’ll cover three topics today. The first is a new study showing that the crisis in health care affordability is real in employer-sponsored health insurance. I’ll also review a microsimulation study of potential savings from increased vaccination rates, and another survey that demonstrates that public health communication around the COVID-19 bivalent boosters has failed miserably.

1. Many who are insured in the United States cannot afford out of pocket costs when they receive care

The Commonwealth Fund released a large survey on the state of insurance in the US last week, and the results are worrisome. Almost a quarter (22%) of those with employer-sponsored health insurance were underinsured, meaning that their out-of-pocket costs (excluding premiums) exceeded 10% of their income, or 5% if they made under 200% of the Federal Poverty Limit. Things were worse for those who purchased their health insurance through the public exchanges, where 44% were underinsured despite an increase in federal subsidies.

Source: Collins, et al, The State of U.S. Health Insurance in 2022: Findings from the Commonwealth Fund Biennial Health Insurance Survey (Commonwealth Fund, Sept. 2022). LINK

This survey found the rate of uninsured individuals is down to 9% nationwide, but 11% of respondents reported that they had a gap in insurance in the previous year, and only 57% of survey respondents had coverage all year and were not underinsured. (Graphic above is for employees of companies with more than 100 employees, where the results are a little better).

Even among those insured adequately (i.e. they did not spend 10% or more of their income on out of pocket costs), almost a third (32%) skipped a test or a prescription or a doctor's visit because of concern about what it would cost. Seventeen percent of those with employer-sponsored health insurance reported they were paying off medical bills over time, and 15% reported that they had been contacted by collection agencies for unpaid bills.

We have a periodic meeting with Chief Medical Officers from a variety of companies, and one reported that when their company investigated individuals who turned down coverage, they found that many of them did so because of premium cost and decided to go uninsured. This surprised them because they had assumed those individuals were using spouse or partner coverage.

Implications for employers:

- Health care affordability remains a large problem, and high medical inflation over the coming years could make this problem worse.

- Most of this problem is due to high unit prices (as opposed to overutilization). This can be addressed through narrow networks and more focus on advantageous health plan provider contracts.

- The WTW 2022 Best Practices Survey shows that 31% of employers currently base health insurance premiums on salaries or job class, and an additional 15% are planning or considering doing so over the next two years. Only one in eight employers examines employee cost sharing as a percent of total compensation.

- Only one in ten employers (10%) structure design to offer lower out-of-pocket costs to those with lower wages.

- Many employers are currently offering, or planning or considering, offering health plan(s) without high deductibles. While these plans don’t offer tax-advantaged health savings accounts, they are likely to leave fewer employees underinsured.

- Some employers improve affordability by offering pre-deductible coverage for some high value drugs which can be characterized as preventive, like generic drugs to treat diabetes, asthma, hypertension and high cholesterol.

2. Employer-sponsored health insurance could save $27 to $34.5 billion with higher vaccination rates this fall

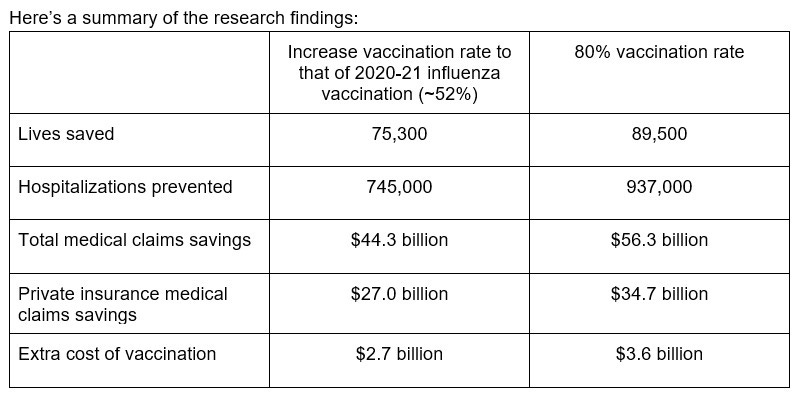

The Commonwealth Fund also reported this week on its microsimulation model showing that a more robust COVID-19 booster uptake could prevent almost a million hospitalizations and almost 90,000 deaths. The researchers compared current (low) rates of vaccination with COVID-19 booster equivalent to influenza vaccination rate (about 52%), and 80% vaccination rate among those eligible.

Here are expected hospitalizations in the three scenarios:

Source: Fitzpatrick et al., “A Fall COVID-19 Booster Campaign Could Save Thousands of Lives, Billions of Dollars,” Commonwealth Fund, Oct. 5, 2022. LINK

Here’s a summary of the research findings:

Microsimulation models are highly dependent on the assumptions used. The Commonwealth Fund team says its cost savings are conservative as they did not assume a new more infectious or more deadly mutation and did not assume higher infections with eased masking guidelines and more traveling for holidays.

This analysis considers only medical claims costs and savings. Decreased time away from work in those who are vaccinated would increase economic value of vaccination, although such an evaluation would also have to consider time away from work to get vaccinated or recover from fever, body aches, or other side effects. The economic stakes for employers are high even if their model overstates the number of infections we would expect without an increase in vaccination rates.

Implications for employers:

- Employers remain a trusted information source - so adding COVID-19 booster information to fall influenza vaccine reminders can make a difference

- This is a good example where prevention does have a 10:1 ROI!

3. Americans are unaware of current COVID-19 vaccination recommendations

A member of my family asked two weeks ago, “Am I eligible for the new COVID-19 bivalent boosters?” This represents a public health communication failure of massive proportions! There has been so much “noise” around the bivalent vaccines that I shouldn’t be surprised that there is such confusion. But as I noted above, the lack of clarity about these boosters will mean we’ll have preventable deaths and hospitalizations, and medical costs will be higher than they should be.

Here is data from the Kaiser Family Foundation vaccine pulse survey:

Source: Kaiser Family Foundation, September 30, 2022 LINK

The underlying problem is that so few people have the right information. Only 49% of fully vaccinated adults were certain they were even eligible for the booster shot. Those who are fully vaccinated are likely to be eligible for this booster, as almost all would have had their last booster over 2-3 months ago, although some might have had a recent COVID-19 infection in which case they might want to wait up to three months.

Here are a few points that can help for those who are debating getting the booster.

- The new booster vaccines produce high levels of antibodies. We don’t know how long these will last, but they are likely to provide good protection through the fall season when we might see another wave of infections

- There have been no “safety signals” so far with the new boosters, and similar Omicron bivalent boosters were fully tested in humans in Europe

- Side effects like sore arms and muscle aches are generally similar or less severe than from previous COVID-19 vaccinations

- People can get the COVID-19 booster and the influenza vaccine at the same time. Separating them makes it more likely people will either forget one, or get the respiratory disease while they are waiting.

- “Timing” the booster to have immunity later means increasing the risk of being infected (or infected again) with COVID-19. The vaccine is extraordinarily safe, and even people who have mild cases of COVID-19 sometimes have long-lasting complications.

#end