Shorts: hospital consolidation, GLP-1s and ODs, nasal COVID vax, Paxlovid and KFF annual survey

October 10, 2024

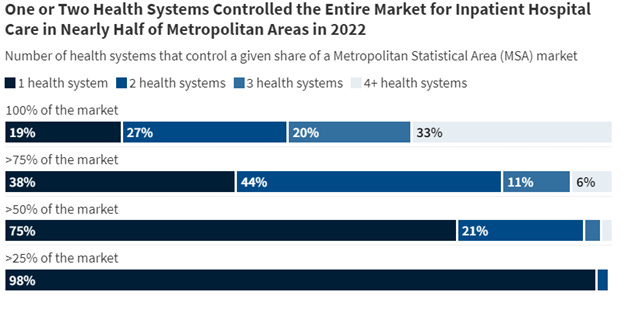

1. Hospital competition continues to decline

Source: Godwin, et al KFF October 1, 2024

KFF just released its most recent evaluation of hospital market concentration - and competition continues to decline. A single network had over one-quarter of hospital discharges in 98% of metropolitan areas, and over 50% of the hospital discharges in three-quarters of metropolitan areas. Only 2% of metropolitan areas were not classified as “highly concentrated” by current antitrust guidelines. This market concentration continues to lead to higher unit prices, and medical carriers often have little leverage to demand price relief.

2. GLP-1 (semaglutide) associated with lower risk of opioid overdose

Researchers scoured a de-identified electronic health record database of 117 million in the US, and extracted about 33,000 who had diagnoses of both Type 2 diabetes and opioid use disorder. They compared those who were treated with semaglutide (Ozempic/Wegovy) with those treated with other drugs and found that those who were treated with semaglutide had a statistically significantly lower rate of overdose compared to those treated with other medications. This research was published in JAMA Network Open, and was performed before tirzepatide (Mounjaro/Zepbound) was widely used.

3. A promising experimental nasal COVID vaccine

A preliminary study among 128 Chinese health workers who had previously been vaccinated against COVID-19 showed that a nasal vaccination was safe and had few adverse side effects. Most importantly, this nasal vaccine (2 sprays 28 days apart) provided high levels of nasal mucosal antibodies. A nasal vaccine that creates a nasal immune barrier to prevent COVID infection could lead to substantial decreases in community infection rates. Nasal vaccines might also gain more widespread adoption than injections and could eventually be self-administered at home.

4. The public is not very aware of Paxlovid

Oral Paxlovid (nirmatrelvir-ritonavir) decreases risk of hospitalization or death among highrisk people from hospitalization and death from COVID-19 by 90%, yet the drug is underutilized. Over half of US adults fall into one or more high risk categories, and treatment must be started within five days of the start of symptoms. Therefore, awareness of the drug is key to at-risk patients gaining access to Paxlovid. In my experience, high risk people with COVID diagnosed by home test often have to persuade their physicians to prescribe Paxlovid.

Researchers in Health Affairs reported last week that about one-third of Americans (31%) had never heard of Paxlovid, and a total of 85% had either low or no awareness of the medication. Awareness of the medication was higher among those who had been vaccinated against COVID, and highest among those who had boosters. Awareness was lowest among those who are Black, Hispanic, and those without a college education. Most respondents were unaware of required timing, overestimated the likelihood of adverse effects, and underestimated the benefits.

Paxlovid has now been commercialized and is no longer provided without cost by the federal government. Employers should be aware that members who have not fulfilled their deductibles will likely have high cost-sharing for this medication unless the employer has continued to waive cost sharing on COVID-19 related medications.

5. Predictions of the next drugs for Medicare negotiations

Researchers in the Journal of Managed Care and Specialty Pharmacy have projected the likely next batch of medications that will be subject to Medicare negotiations. These drugs include treatments for diabetes (Ozempic, Tradjenta, Janumet), drugs for lung disease (Trelegy Ellipta, Spiriva, Anoro) and drugs to treat idiopathic pulmonary fibrosis, irritable bowel syndrome, hepatitis C, and schizophrenia. If Ozempic is on this list, a negotiated price would apply to Wegovy prescribed for Medicare enrollees, since they are the same drug with different labeling.

New prices for Medicare for the drugs negotiated during 2024 will go into effect in January, 2026. The actual drugs for negotiation will be announced during 2025 and negotiated prices for this new set of drugs will go into effect in January, 2027. Here is a post on the 2026 CMS negotiated prices, and a post on projecting impact of these CMS negotiations on commercial drug prices.

6. KFF publishes its annual health care survey

KFF, formerly Kaiser Family Foundation, published its annual health care survey yesterday. I’ll discuss this further in a future post, but here are a few initial observations:

Family premiums were up 7% to $25,572

Worker premiums in the last five years went up more (24%) than worker share of premiums (5%), which surprised me. Employers are not passing on all of the increased cost.

Employers gave muddled answers about their understanding of PBMs and Rx rebates. KFF has a separate article out on this issue today, too.

KFF reports very low rates of coverage of GLP-1 anti-obesity medications: 18% for employers with over 200 employees, and 28% for employers with over 5000 employees. In contrast, the WTW Best Practices Survey showed that 52% of employers provided coverage for these drugs for obesity. Sixty-eight percent of companies with 5,000 to 9,999 employees said they provided coverage, and 60% of companies with over 25,000 employees provided coverage for these medications for obesity. The KFF survey was fielded earlier in 2024, and it’s possible that more respondents were not yet sure whether or not they were covering these drugs when they were surveyed.

Almost two-thirds of employees (63%) were in firms that self-funded their health insurance plans.

Over a quarter (29%) of employers offered salary banding to make premiums more affordable for low-wage workers, similar to the 27% reported in the WTW Best Practices Survey.