Job-based health coverage unaffordable for many

March 25, 2025

Source: Kolb, et al Commonwealth Fund March 13, 2025

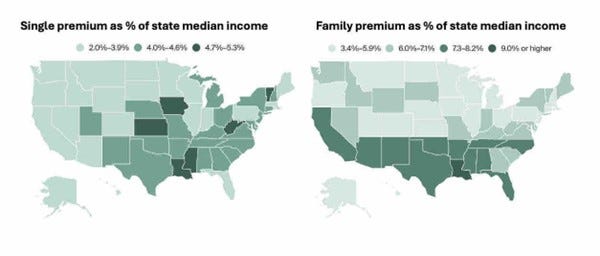

The Commonwealth Fund just published research that evaluated the affordability of employer-sponsored health insurance for employees. Researchers found that wage increases between 2020-2023 slightly decreased the portion of total income that went to premiums and deductibles, but average premiums plus deductible for a family plan were still, on average, over 10% of household income across the U.S., and were over 12% of household income in six states (FL, LA, NM, OK, TN and TX).

This does not include copayments and coinsurance but includes deductibles for many households which do not reach their deductible. This study focused on the cost of premiums and deductibles compared to each states’ median income. Those earning less than the state median income could face more financial insecurity from health care premiums and deductibles. Employers paid on average between 65% and 85% of insurance premiums.

Single deductibles averaged $1,930 across the country, and were more than 5% of household income in 24 states. While employee premiums and deductibles were often higher in relatively wealthier states, these represented a higher portion of total household income in less wealthy states.

Researchers used the federal Medical Expenditure Panel Study (MEPS), which collects detailed data on household health insurance and medical expenditures.

Here’s a link to research from The Big Paycheck Squeeze (2023), by Steve Nyce and Billie Jean Miller of WTW’s Research and Innovation Center, which also describes the problem of health insurance costs leading to lower wages and compensation

Implications for employers:

● Health care costs create the largest financial challenges for lower income workers, for whom the premiums and deductibles represent the largest portion of household income.

● Employers can use salary banding to decrease the burden on lower income employees and their families, but this requires increasing the cost burden on higher income employees.

● Rising medical inflation continues to pose a challenge to sustainability of employer-sponsored health insurance for both employers and their workers.

Previous posts on this issue:

- Increased health insurance costs lead to lower employee wages (March, 2025)

- Employer-sponsored health insurance can paradoxically worsen income inequality (January, 2024)

- The impact of medical costs on family budgets (June, 2024)

Thanks for reading. You can find previous posts in the Employer Coverage archive

Please subscribe, “like” share this newsletter with friends and colleagues. Thanks!

Tomorrow: Lactation support improves newborn outcomes